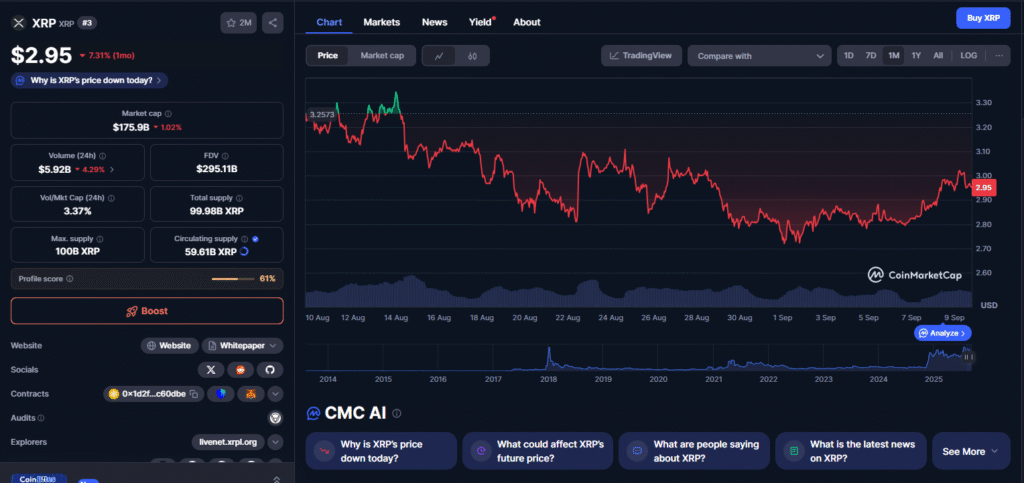

The price of XRP retreated to $2.95, momentarily losing the psychological support of $3.00. Although the correction raised doubts among investors, analysts point out that the digital asset still maintains technical and market fundamentals that could drive an attempt to rally toward $5.00 in the coming months.

XRP loses strength and pulls back against the crypto market

In the last 24 hours, XRP fell 0.72%, settling at $2.95, while the overall cryptocurrency market declined 0.51% over the same period.

The drop reignited debate about the token’s ability to sustain its rally, especially after a 30% surge over the past three months.

Technical analysis: key resistances and mixed signals

- Immediate resistance: 30-day moving average at $2.97.

- Critical support: 61.8% Fibonacci level at $2.95.

- Indicators: MACD shows weak bullish momentum, while RSI at 52.88 reflects neutrality.

Traders appear to be taking profits after the recent rise, and $3.05 has become a psychological selling point, as 12.5% of addresses bought in that zone.

If the price breaks below $2.84 (200-day moving average), a chain of stop-losses could be triggered, increasing bearish pressure.

Whales and institutions: strategic XRP sales

On-chain data reveals that whales moved more than 180 million tokens ($531 million) to exchanges such as BitStamp and Bitso in the past week.

This adds to the $200 million sale made in July by Chris Larsen, Ripple’s co-founder.

The flow suggests that large investors are reducing exposure while waiting for regulatory decisions scheduled for October, when the SEC will review several XRP ETF applications.

In addition, the 30-day MVRV index, positive at 8.01%, indicates that profitable positions still exist that could fuel further selling pressure.

Regulation and institutional outlook

The regulatory framework remains decisive:

- In August, the CFTC classified XRP as a commodity, which drove a 27% surge.

- However, uncertainty over SEC appeals and the implementation of the new Genius Act keeps the market cautious.

- Meanwhile, Ripple filed a banking application with the OCC, reinforcing its strategy to consolidate itself as a bridge between traditional finance and the crypto ecosystem.

What do analysts say about XRP’s future?

Arthur Azizov (B2 Ventures): highlights that trading volumes tripled around $3.00, reflecting strong institutional interest. He believes that breaking above $3.05 could open the way to $3.30 – $3.50, especially if an ETF is approved.

Rupert (Allincrypto Podcast): argues that XRP is in consolidation and even points to an ambitious long-term target of $19.27, considering the breakout of previous all-time highs.

Furthermore, partnerships such as the recent collaboration with BBVA Bank in digital custody services strengthen Ripple’s bullish outlook in the medium and long term.

Conclusion: Is XRP heading toward $5?

In the short term, the range between $2.84 and $2.95 will serve as key support, while immediate resistance remains at $3.05.

If it manages to break through that level with strength, XRP could regain momentum toward $5.00, although the risks of further corrections remain present.